The topmost band is a higher deviation from the standard moving average of that price graph and the lower band is a lower deviation. This indicator graphs a price chart based on two lines or bands. It gauges high and low volatility scenarios and measures amount of volatility for analysis.

Bollinger bands forex tsd. Variation average higher lower. It could be interesting to trade the pair which offer the best volatility.

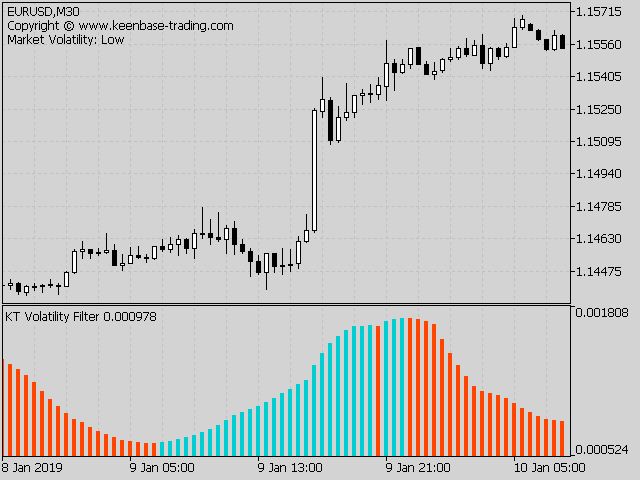

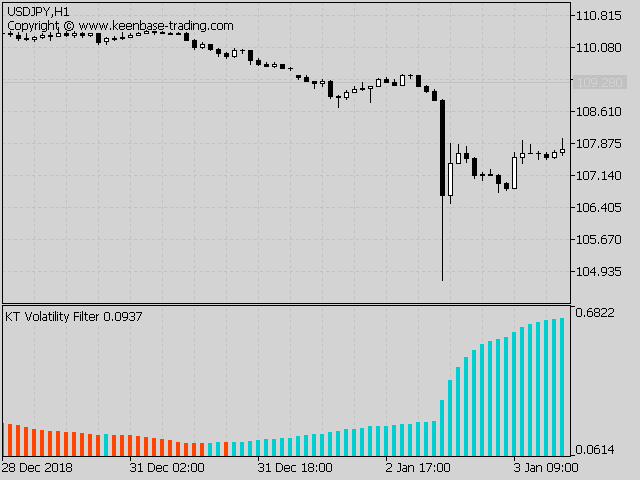

You have to define the period to calculate the average of the volatility. The following table represent the currency s daily variation measured in pip in and in with a size of contract at 100 000. Once the red line volatility crosses the blue line aggressiveness this can be seen as the start of a trending move.

An interesting indicator from the forex tsd days called silence which helps you to determine flat price action no trend and the beginning of a volatile move. Time frame 5min or 15min. Dz nma atr scalping is a trend volatility system that work at the 5 min or 15 min time frame.

Submit by picker 18 07 2015. Here is how it looks with dynamically built normal level of volatility high volatility level of 3 is still kept i think it is a reasonable choice for something like that volatility ratio stepped mq4. If one prefers fixed level 1 for normal volatility then simply set the deviationsforsteps parameter to 0 or less than 0.

These lines are variously known as channels envelopes or bands. Volatility channels are a type of indicator that plot volatility related lines above and below the market. A forex volatility meter that dispenses with direction and tells you purely about the magnitude of volatility is the average true range indicator or atr.

Fareastol here you go upper is daily wolatility you still have to specify number of weeks of data you want default is 12 which is roughly 3 moths it also takes into account sunday data too if exists here is an example of a broker with existing sunday data upper is the daily volatility lower is the intraday.

Forex tsd volatility daily indicator. Bollinger bands 30 2 2 cover and go long when daily closing price crosses below the lower band. Cover and go short when daily closing price crosses above the upper band. Macd 12 26 9 cover and go long when macd1 fast crosses above macd2 slow. Cover and go short when macd1 crosses below macd2.

Using adx as a volatility indicator. The adx indicator measures the strength of a trend based on the highs and lows of the price bars over a specified number of bars typically 14. Generally an adx crossing of the 20 or 25 levels is considered the beginning of a trend either an uptrend or a downtrend. Forex tsd daily volatility.

Forex tsd daily volatility. Generally an adx crossing of the 20 or 25 levels is considered the beginning of a trend either an uptrend or a downtrend. The adx indicator measures the strength of a trend based on the highs and lows of the price bars over a specified number of bars typically 14.

Using adx as a volatility indicator. Cover and go short when macd1 crosses below macd2. Macd 12 26 9 cover and go long when macd1 fast crosses above macd2 slow.

Cover and go short when daily closing price crosses above the upper band. Bollinger bands 30 2 2 cover and go long when daily closing price crosses below the lower band.